Some Known Incorrect Statements About Stonewell Bookkeeping

Examine This Report on Stonewell Bookkeeping

Table of ContentsThe Basic Principles Of Stonewell Bookkeeping More About Stonewell BookkeepingSee This Report on Stonewell BookkeepingSome Known Facts About Stonewell Bookkeeping.Stonewell Bookkeeping Can Be Fun For Anyone

Right here, we respond to the concern, just how does accounting aid a company? Truth state of a company's funds and capital is always in flux. In a sense, accounting publications stand for a picture in time, but only if they are updated typically. If a firm is taking in little, an owner should take activity to boost earnings.

It can also fix whether or not to raise its own settlement from customers or customers. None of these verdicts are made in a vacuum cleaner as accurate numeric info must copyright the financial choices of every small organization. Such data is compiled with bookkeeping. Without an intimate knowledge of the characteristics of your cash money circulation, every slow-paying customer, and quick-invoicing creditor, ends up being an occasion for stress and anxiety, and it can be a laborious and boring job.

You understand the funds that are readily available and where they drop short. The information is not always great, but at least you understand it.

Stonewell Bookkeeping Can Be Fun For Anyone

The labyrinth of deductions, credit ratings, exceptions, timetables, and, naturally, charges, is adequate to simply surrender to the internal revenue service, without a body of efficient documents to sustain your insurance claims. This is why a dedicated accountant is invaluable to a tiny service and deserves his or her weight in gold.

Those charitable payments are all enumerated and accompanied by info on the charity and its payment info. Having this info in order and close at hand allows you submit your income tax return effortlessly. Remember, the federal government doesn't fool around when it's time to file tax obligations. To ensure, a business can do every little thing right and still be subject to an IRS audit, as numerous already understand.

Your company return makes insurance claims and depictions and the audit targets at validating them (https://anyflip.com/homepage/lhcti). Good bookkeeping is all about linking the dots between those representations and fact (bookkeeping services near me). When auditors can follow the you can try these out info on a journal to receipts, bank statements, and pay stubs, among others records, they promptly find out of the expertise and integrity of business company

See This Report on Stonewell Bookkeeping

In the same way, haphazard accounting includes in tension and anxiety, it also blinds company owner's to the potential they can understand in the lengthy run. Without the information to see where you are, you are hard-pressed to establish a destination. Only with understandable, thorough, and valid information can an organization owner or administration team story a program for future success.

Company owner understand ideal whether an accountant, accountant, or both, is the best service. Both make crucial contributions to a company, though they are not the same occupation. Whereas a bookkeeper can collect and arrange the details required to sustain tax preparation, an accountant is better suited to prepare the return itself and really assess the revenue statement.

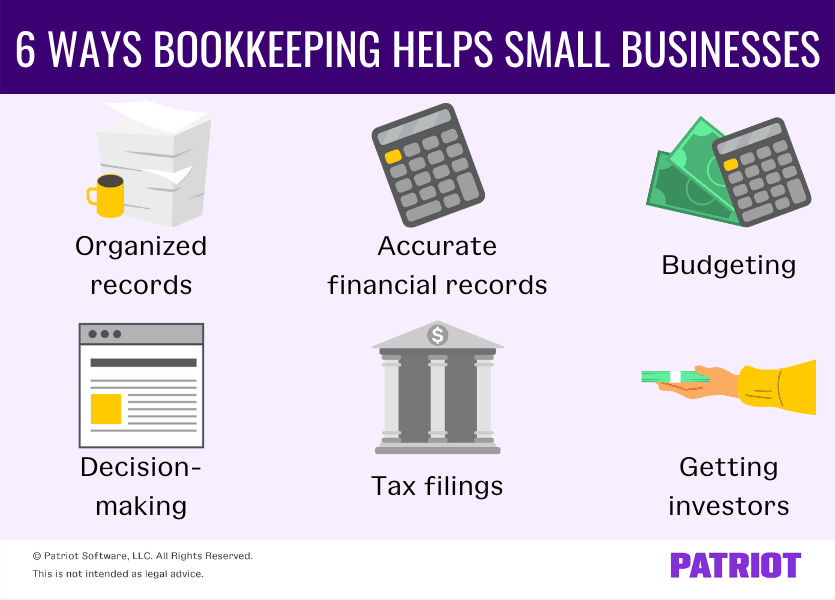

This short article will dive right into the, including the and how it can benefit your organization. Bookkeeping entails recording and arranging financial deals, consisting of sales, acquisitions, settlements, and invoices.

By routinely upgrading financial records, accounting assists services. Having all the financial info easily obtainable maintains the tax obligation authorities satisfied and stops any kind of final headache throughout tax obligation filings. Regular bookkeeping ensures properly maintained and well organized records - https://anyflip.com/homepage/lhcti. This aids in conveniently r and conserves companies from the tension of looking for documents during deadlines (bookkeeping services near me).

Stonewell Bookkeeping Fundamentals Explained

They also desire to recognize what potential the service has. These elements can be quickly handled with accounting.

Thus, bookkeeping assists to prevent the troubles associated with reporting to financiers. By keeping a close eye on economic records, organizations can establish reasonable goals and track their development. This, consequently, cultivates far better decision-making and faster business growth. Federal government regulations often require companies to maintain economic documents. Normal accounting ensures that services remain compliant and stay clear of any penalties or lawful problems.

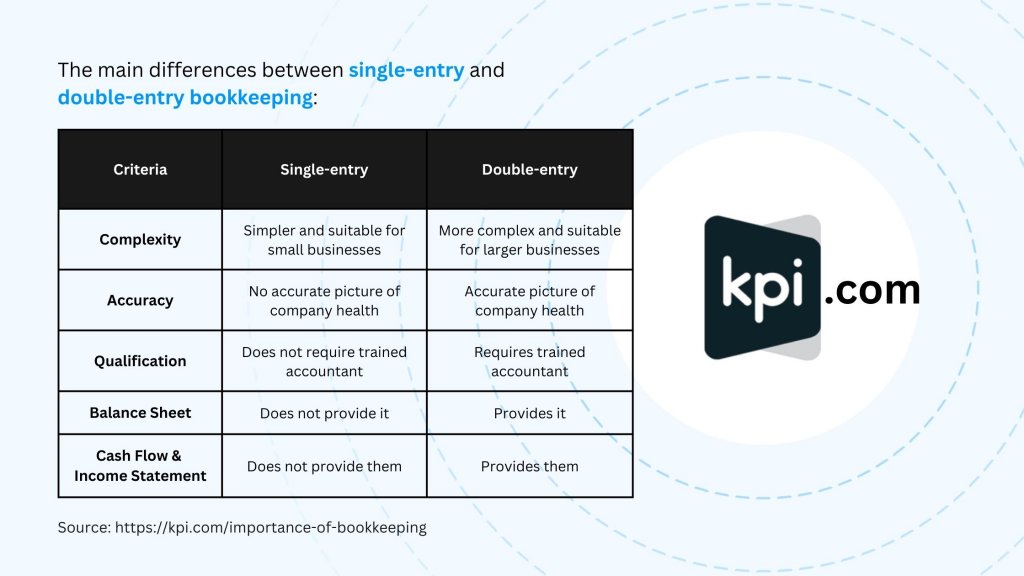

Single-entry accounting is easy and works ideal for little businesses with few deals. It does not track possessions and obligations, making it much less detailed contrasted to double-entry bookkeeping.

Stonewell Bookkeeping Fundamentals Explained

This might be daily, weekly, or monthly, depending on your organization's size and the quantity of deals. Don't think twice to seek assistance from an accounting professional or bookkeeper if you find managing your monetary records challenging. If you are trying to find a cost-free walkthrough with the Audit Option by KPI, contact us today.